In global trade, speed and compliance go hand in hand. For businesses shipping goods in and out of the Gulf Cooperation Council (GCC) — which includes the UAE, Saudi Arabia, Qatar, Oman, Bahrain, and Kuwait — customs clearance, HS codes, and Incoterms are the backbone of smooth operations. Whether you are an importer, exporter, or freight forwarder, understanding these processes can help you avoid costly delays, penalties, and disputes.

What is Customs Clearance in the GCC?

Customs clearance is the process of preparing and submitting the required documents to government authorities so that cargo can legally enter or exit a country. In the GCC, customs authorities are strict about documentation, valuation, and compliance.

The typical customs clearance process includes:

-

Documentation – Submitting key documents like commercial invoices, packing lists, certificate of origin, bill of lading/airway bill, and permits (if applicable).

-

HS Code Classification – Declaring the correct Harmonized System (HS) code to identify the product type and applicable duty rate.

-

Duties & Taxes – Paying customs duties, VAT (5% in UAE, KSA, Bahrain, Oman; 0% in some free zones), and other charges.

-

Inspection & Release – Customs may inspect goods physically or via scanning before approving release.

For example, in Dubai (UAE), customs clearance is often completed digitally through the Dubai Trade portal, which speeds up processing. In Saudi Arabia, clearance is handled through the FASAH platform.

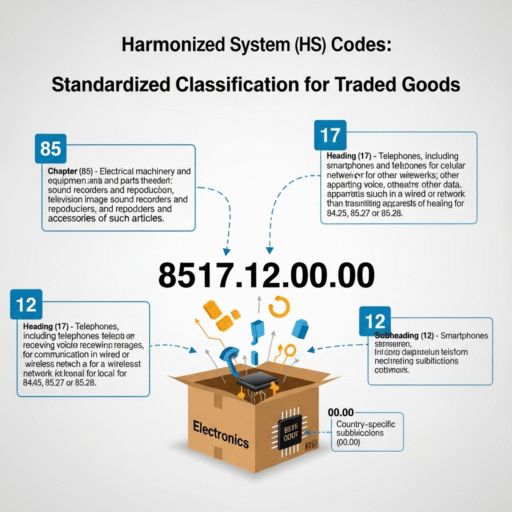

HS Codes: The Key to Correct Declarations

The Harmonized System (HS) code is a standardized numerical method of classifying traded products. It’s used worldwide and is essential for:

-

Determining customs duty rates.

-

Ensuring compliance with import/export restrictions.

-

Facilitating trade data analysis.

Example:

-

HS Code 6403.59 → Leather footwear with outer soles of rubber, plastic, or leather.

-

HS Code 8703.23 → Motor cars with cylinder capacity >1500cc but ≤3000cc.

In the GCC, a wrong HS code can lead to:

-

Delayed clearance.

-

Overpayment of duties.

-

Customs penalties or shipment seizures.

Tip for Businesses: Always confirm the HS code with your freight forwarder or use official tariff look-up portals provided by customs authorities (e.g., UAE Federal Customs Authority’s HS Code directory).

Incoterms: Defining Buyer and Seller Responsibilities

Incoterms (International Commercial Terms) are globally recognized rules that define who is responsible for costs, risks, and tasks in shipping transactions. In GCC trade, Incoterms are critical to avoid disputes.

Here are a few commonly used Incoterms:

-

EXW (Ex Works) – Buyer arranges everything from seller’s premises onwards.

-

FOB (Free on Board) – Seller handles costs until goods are loaded on the vessel. Buyer covers freight and beyond.

-

CIF (Cost, Insurance, and Freight) – Seller pays for carriage and insurance until goods reach the destination port.

-

DAP (Delivered at Place) – Seller delivers goods to buyer’s location, excluding import clearance and duties.

-

DDP (Delivered Duty Paid) – Seller bears all costs, including import clearance and duties.

Example in the GCC:

-

A Dubai exporter selling to a buyer in Saudi Arabia under CIF Jeddah would cover shipping and insurance to Jeddah port. But customs clearance and duties in Saudi Arabia are the buyer’s responsibility.

Why Businesses in the GCC Must Get This Right

-

Delays Kill Deals – Incorrect HS codes or missing documents can delay shipments by weeks.

-

Compliance Risks – Customs violations can lead to penalties, fines, or blacklisting.

-

Financial Loss – Misapplied Incoterms may shift unexpected costs to your business.

By working with an experienced freight forwarder, SMEs and enterprises in the GCC can streamline customs clearance, reduce errors, and gain supply chain visibility.

Final Thoughts

Customs clearance, HS codes, and Incoterms are not just paperwork — they are the rules of the game in GCC logistics. Mastering them means faster clearance, lower costs, and stronger customer trust.

At Al Furqan Shipping & Logistics Dubai, www.alfurqanshipping.com we guide clients through every step — from selecting the right HS code to negotiating the best Incoterms for their shipments. That’s how businesses save time, cut costs, and stay compliant.

✅ Pro Tip for Shippers: Use freight calculators and HS code directories to estimate duties and shipping costs before confirming deals.

👉 Try our Freight Calculator