Last Mile Delivery in Gulf Countries

Last mile delivery Gulf countries face unique challenges that set them apart from other global markets. This comprehensive guide is designed for logistics professionals, e-commerce businesses, supply chain managers, and investors looking to understand or expand into Gulf region logistics.

The Middle East delivery solutions market is booming, driven by rapid urbanization, extreme weather conditions, and diverse customer expectations across countries like the UAE and Saudi Arabia. From Dubai’s skyscrapers to Riyadh’s sprawling suburbs, delivery companies must adapt to vastly different geographical and cultural landscapes.

We’ll explore how Gulf logistics technology is transforming traditional delivery methods, from AI-powered route optimization to drone delivery pilots in major cities. You’ll discover the strategic partnerships between global logistics giants and local players that are reshaping Saudi Arabia delivery services and other regional markets.

We’ll also examine the operational hurdles that make Gulf supply chain management particularly complex, including labor regulations, infrastructure variations, and seasonal demand fluctuations. Finally, we’ll look at emerging Middle East e-commerce delivery trends and Gulf delivery optimization strategies that will define the industry’s future over the next decade.

Understanding the Gulf Region’s Unique Last Mile Delivery Landscape

Geographic and Climatic Challenges Affecting Delivery Operations

The Gulf region presents distinctive environmental hurdles that significantly impact last mile delivery Gulf countries operations. Extreme temperatures regularly exceeding 50°C during summer months create substantial challenges for logistics providers. These harsh conditions affect vehicle performance, driver safety, and product integrity, particularly for temperature-sensitive items.

Desert terrain and sandstorms pose additional complications for delivery routes. Sand accumulation can make certain areas temporarily inaccessible, while visibility issues during sandstorms create safety concerns for drivers. The vast distances between urban centers across countries like Saudi Arabia and UAE require specialized logistics planning to maintain efficient delivery networks.

Coastal humidity in cities like Dubai and Doha affects packaging materials and electronic goods, demanding specialized protective measures. The region’s unique geography, with its mix of desert landscapes, mountain ranges, and coastal areas, requires delivery services to adapt their operations based on specific local conditions.

Urban Sprawl and Infrastructure Development Patterns

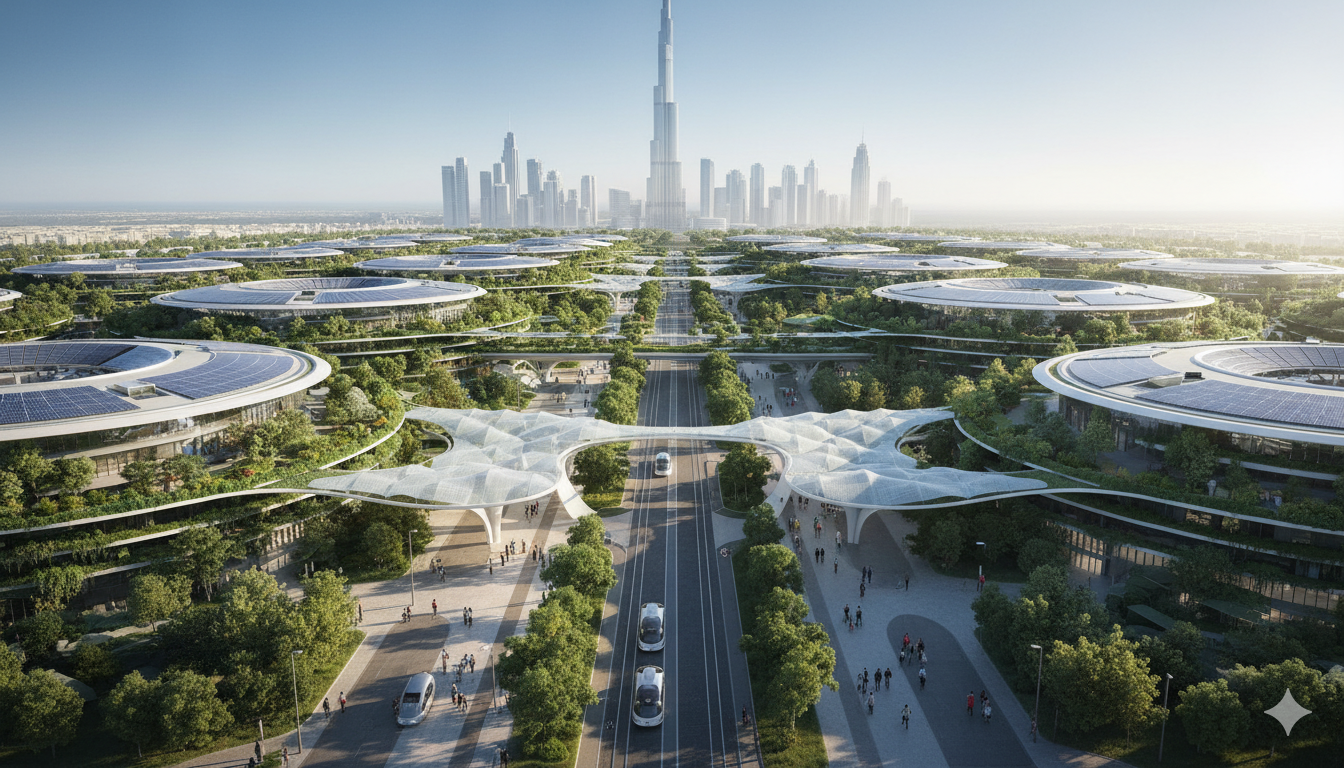

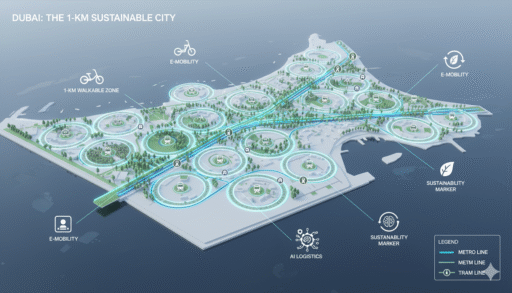

Gulf region logistics networks must navigate rapidly expanding metropolitan areas characterized by ambitious urban development projects. Cities like Riyadh, Dubai, and Doha feature sprawling residential compounds, expansive shopping districts, and continuously evolving road networks that challenge traditional delivery mapping systems.

The region’s preference for gated communities and private compounds creates access control complexities that don’t exist in other markets. Many residential areas require pre-authorization for deliveries, adding extra steps to the fulfillment process. Address standardization remains inconsistent across different emirates and provinces, making accurate delivery location identification challenging.

Major infrastructure projects, including metro systems, new highways, and smart city developments, create both opportunities and temporary disruptions for delivery operations. Construction zones frequently alter established delivery routes, requiring constant route optimization and real-time navigation updates.

Cultural Preferences and Consumer Expectations

Middle East delivery solutions must align with distinct cultural practices and consumer behaviors. The traditional preference for cash-on-delivery payment methods, while decreasing, still represents a significant portion of transactions, requiring delivery personnel to handle monetary exchanges and potential return scenarios.

Weekend schedules differ from Western markets, with Friday-Saturday weekends in most Gulf countries affecting delivery windows and customer availability. Ramadan significantly alters delivery patterns, with increased evening and night-time deliveries to accommodate fasting schedules and extended shopping hours.

Cultural expectations around customer service standards are exceptionally high, with consumers expecting personalized communication and flexible delivery arrangements. The multicultural population in cities like Dubai and Doha means delivery services must accommodate diverse language preferences and cultural sensitivities.

Family-oriented shopping behaviors often result in larger order sizes and specific delivery timing requests to coordinate with household schedules. The tradition of majlis (social gatherings) influences delivery preferences, with customers often requesting specific time slots that don’t interfere with social obligations.

Regional Economic Factors Driving E-commerce Growth

Gulf supply chain management benefits from robust economic fundamentals that fuel rapid e-commerce expansion. High disposable incomes across the region create strong demand for premium delivery services and expedited shipping options. The young, tech-savvy population, with over 60% under 30 years old in most Gulf countries, drives digital adoption and online shopping growth.

Government initiatives promoting economic diversification beyond oil revenues have prioritized e-commerce development. Vision 2030 in Saudi Arabia and similar national strategies actively support digital transformation, creating favorable conditions for UAE last mile delivery and broader regional logistics expansion.

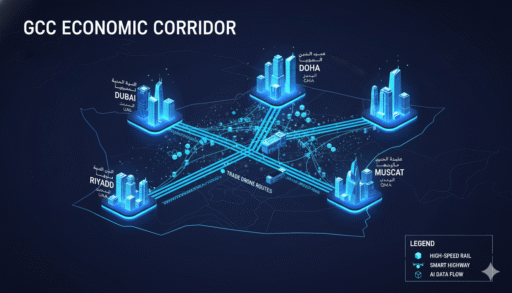

The region’s strategic position as a global trade hub, with world-class ports and airports, facilitates international e-commerce growth. Free trade zones and business-friendly policies attract global retailers and logistics providers, intensifying competition and innovation in delivery services.

Tax-free shopping environments in many Gulf countries make online purchases attractive to consumers, while government investments in digital infrastructure, including 5G networks and smart city initiatives, create the technological foundation necessary for advanced Gulf logistics technology implementations.

Technology Solutions Revolutionizing Last Mile Delivery

AI-powered route optimization systems reducing delivery times

Gulf logistics companies are embracing artificial intelligence to tackle the region’s unique delivery challenges. These smart systems analyze real-time traffic data, weather conditions, and delivery patterns to create the most efficient routes for drivers. In busy cities like Dubai and Riyadh, AI algorithms can reduce delivery times by up to 30% while cutting fuel costs significantly.

The technology considers multiple variables that traditional routing systems miss. Prayer times, construction zones, peak shopping hours, and even cultural events get factored into route planning. This level of sophistication proves essential in Gulf markets where local customs and infrastructure variations can dramatically impact delivery schedules.

Companies using AI-powered optimization report better driver satisfaction too. When routes make logical sense and avoid unnecessary backtracking, drivers complete their rounds with less stress and fatigue. The system learns from each delivery, continuously improving its recommendations based on actual performance data.

IoT tracking devices enhancing package visibility

Internet of Things sensors are transforming how Gulf region logistics providers monitor shipments. These small devices attach to packages and provide real-time location updates, temperature readings, and handling information throughout the delivery journey. Customers can track their orders with unprecedented accuracy, knowing exactly where their package is at any moment.

The technology addresses a major pain point in Middle East e-commerce delivery – package visibility during transit. Traditional tracking systems often show limited updates, leaving customers guessing about delivery timing. IoT devices eliminate this uncertainty by providing continuous data streams.

Temperature-sensitive shipments benefit enormously from IoT monitoring. In the Gulf’s extreme heat, pharmaceuticals, electronics, and food items need careful temperature control. Smart sensors alert logistics teams immediately if temperature thresholds are exceeded, allowing quick corrective action to prevent product damage.

Battery life and connectivity remain key considerations for IoT implementation. Modern devices can operate for weeks on a single charge while maintaining reliable cellular or satellite connections across the region’s vast distances.

Drone delivery pilots transforming remote area access

Several Gulf countries are pioneering drone delivery services to reach remote locations that traditional vehicles struggle to access efficiently. The UAE leads these efforts, with Dubai implementing regular drone routes for medical supplies and small packages. These aerial delivery systems can reach desert communities and offshore locations in a fraction of the time required by ground transportation.

Regulatory frameworks are evolving to support drone operations. Aviation authorities across the Gulf are establishing dedicated air corridors for commercial drones while ensuring safety standards remain high. The technology shows particular promise for emergency medical deliveries and time-sensitive documents.

Weather conditions present unique challenges for drone operations in the region. Sandstorms, high temperatures, and strong winds require robust aircraft designs and sophisticated flight control systems. Companies are developing specialized drones that can handle these environmental factors while maintaining reliable performance.

Current pilots focus on shorter routes and lighter payloads, but the technology is rapidly advancing. Future iterations promise longer range capabilities and larger cargo capacity, potentially revolutionizing last mile delivery across the Gulf’s challenging geography.

Mobile apps streamlining customer communication

Delivery apps have become the primary communication channel between logistics providers and customers throughout the Gulf region. These platforms offer real-time updates, delivery scheduling options, and direct messaging with drivers. Customers can reschedule deliveries, provide specific instructions, and rate their experience all through a single interface.

Language support proves critical for app success in diverse Gulf markets. Leading platforms offer Arabic, English, and several South Asian languages to serve the region’s multicultural population. Voice messaging features help bridge communication gaps between customers and drivers who may speak different languages.

Payment integration within delivery apps streamlines the entire process. Customers can pay for cash-on-delivery orders digitally, eliminating the need for exact change and reducing contact time. This feature gained particular importance during pandemic restrictions but continues to offer convenience benefits.

App-based feedback systems help logistics companies identify service improvements quickly. Customer ratings and comments provide immediate insights into delivery performance, allowing rapid responses to emerging issues. The data also helps optimize driver assignments and identify training opportunities.

Push notifications keep customers informed without overwhelming them. Smart notification systems learn user preferences and adjust timing accordingly, ensuring important updates get noticed while avoiding notification fatigue that leads to app abandonment.

Strategic Partnerships Driving Delivery Excellence

Collaborations between international and local logistics providers

Global logistics giants have recognized the immense potential of Gulf markets, leading to strategic alliances with established regional players. DHL’s partnership with Aramex has created a robust network spanning multiple Gulf countries, combining international expertise with local market knowledge. These collaborations leverage the strengths of both parties – international providers bring advanced technology and operational best practices, while local partners contribute deep cultural understanding and established customer relationships.

FedEx has formed strategic alliances with local courier services across the UAE and Saudi Arabia, creating hybrid delivery networks that can handle both high-volume commercial shipments and intricate last mile delivery Gulf countries requirements. These partnerships often involve shared infrastructure, cross-training programs, and integrated tracking systems that provide seamless service to customers.

The success of these collaborations lies in their ability to navigate complex regulatory environments while maintaining service quality. Local partners help international companies understand cultural nuances, preferred delivery times, and customer expectations specific to Gulf region logistics. This knowledge proves invaluable when designing delivery schedules around prayer times, cultural holidays, and local business practices.

Joint ventures have also emerged in specialized sectors like cold chain logistics and pharmaceutical delivery, where both parties pool resources to meet stringent regulatory requirements while expanding their service capabilities across the region.

Government initiatives supporting supply chain development

Gulf governments have launched comprehensive programs to transform their logistics sectors into global hubs. The UAE’s Dubai Logistics City initiative represents a massive investment in creating an integrated logistics ecosystem, featuring dedicated last mile delivery facilities, customs clearance zones, and advanced distribution centers.

Saudi Arabia’s Vision 2030 includes substantial funding for logistics infrastructure development, with specific focus on enhancing delivery networks throughout the kingdom. The Saudi Logistics Hub program aims to position the country as a regional distribution center, directly impacting Saudi Arabia delivery services capabilities across the region.

Qatar’s National Development Strategy 2030 allocates significant resources to modernizing supply chain infrastructure, including smart delivery hubs and automated sorting facilities. These government-backed initiatives create favorable conditions for private sector partnerships and technology adoption.

Regulatory reforms have simplified business licensing procedures for logistics companies, enabling faster market entry and partnership formation. Free zone policies in major Gulf countries offer tax incentives and streamlined operations for international logistics providers looking to establish regional headquarters.

Digital government platforms now integrate with private logistics networks, allowing real-time tracking and compliance monitoring that benefits both regulatory oversight and customer service quality across Gulf supply chain management operations.

Retail partnerships expanding delivery network reach

Major retail chains across the Gulf have transformed their partnerships with delivery providers to create comprehensive omnichannel experiences. Carrefour’s collaboration with local delivery services in the UAE has enabled same-day delivery across multiple emirates, setting new standards for Middle East e-commerce delivery.

Shopping mall operators have partnered with logistics companies to create centralized distribution hubs within retail complexes, reducing delivery distances and improving speed. The Mall of Emirates and Dubai Mall have integrated delivery stations that serve as last-mile consolidation points for multiple retailers.

Grocery chains like Lulu Group have developed exclusive partnerships with specialized delivery services, creating dedicated fleets for perishable goods delivery. These partnerships include shared investment in refrigerated vehicles and temperature-controlled storage facilities.

E-commerce platforms have forged multi-vendor partnerships that allow small retailers to access sophisticated delivery networks previously available only to large corporations. Noon’s partnership network includes over 100 local delivery providers across the Gulf, creating redundancy and ensuring service continuity.

Fashion retailers have collaborated with delivery services to offer unique services like try-before-you-buy programs, where customers can examine products at home before completing purchases. These partnerships require sophisticated reverse logistics capabilities and real-time inventory management systems.

Pharmacy chains have developed specialized partnerships for prescription delivery services, ensuring compliance with medical regulations while providing convenient healthcare access. These collaborations often include licensed medical courier services and secure handling protocols for controlled substances.

Overcoming Operational Challenges in Gulf Markets

Managing extreme weather conditions and seasonal demands

The Gulf’s scorching summers present unique challenges for last mile delivery operations. Temperatures soaring beyond 50°C (122°F) damage sensitive products, strain delivery vehicles, and create safety concerns for drivers. Companies operating in the region have learned to adapt their strategies around these harsh conditions.

Peak summer months see delivery windows shift to early morning and late evening slots, with many operators suspending midday deliveries entirely. This compressed timeframe increases operational complexity and requires careful route optimization to maximize efficiency. Cold storage facilities and refrigerated vehicles become essential for maintaining product integrity, particularly for food, pharmaceuticals, and electronics.

Seasonal demand fluctuations add another layer of complexity. Ramadan brings dramatic changes in consumption patterns, with delivery volumes spiking during pre-dawn and evening hours. The holy month requires complete operational restructuring, as traditional delivery schedules become incompatible with fasting hours and cultural practices.

Shopping festivals and promotional periods in countries like the UAE and Saudi Arabia create massive volume surges that test delivery infrastructure. Black Friday, White Friday, and national day celebrations can increase package volumes by 300-400% within days, demanding scalable solutions and surge capacity planning.

Weather-adaptive technology helps companies navigate these challenges. Real-time temperature monitoring systems alert drivers to product-sensitive deliveries, while predictive analytics help anticipate weather-related delays. Many providers now offer temperature-controlled last mile solutions as standard service rather than premium options.

Addressing skilled workforce shortages in logistics sector

The Gulf logistics sector faces persistent talent shortages, particularly in specialized roles requiring technical expertise and local market knowledge. This gap directly impacts last mile delivery efficiency and service quality across the region.

Traditional recruitment approaches struggle to attract local talent, as logistics roles often compete with more prestigious sectors like finance and technology. The physical demands of delivery work, combined with challenging weather conditions, make driver recruitment especially difficult.

Training programs have become critical investments for successful operations. Companies partner with local educational institutions to develop logistics-focused curricula that address both technical skills and cultural awareness. These programs often include:

-

Route optimization software training

-

Customer service protocols specific to Gulf cultures

-

Safety procedures for extreme weather conditions

-

Technology platform proficiency

-

Language skills development for diverse customer bases

International talent acquisition strategies help bridge immediate gaps, but visa processing delays and cultural adaptation challenges can slow integration. Many companies now maintain dedicated training centers that fast-track new hires through intensive programs covering local regulations, geography, and customer expectations.

Technology adoption helps compensate for workforce limitations. Automated sorting systems, AI-powered route planning, and self-service delivery options reduce dependency on skilled labor while improving operational efficiency. However, the human element remains crucial for handling complex deliveries and maintaining customer relationships in relationship-focused Gulf markets.

Navigating complex addressing systems in developing areas

Traditional addressing systems across Gulf countries often lack the precision required for efficient last mile delivery. Many areas, particularly in rapidly developing suburbs and industrial zones, rely on landmark-based directions rather than standardized street addressing.

This creates significant operational challenges for delivery teams. A typical address might read “behind the blue mosque, third villa from the roundabout,” requiring local knowledge and time-consuming navigation. GPS systems frequently fail in newer developments where mapping data lags behind construction, leaving drivers to rely on phone calls and visual landmarks.

The situation varies dramatically between urban centers and outlying areas. Cities like Dubai and Doha have implemented comprehensive addressing systems with building numbers and postal codes, while rural and developing regions maintain traditional naming conventions. This inconsistency forces companies to develop multiple navigation strategies within single operational areas.

Digital mapping initiatives are gradually improving the situation. Partnerships with mapping providers help companies contribute location data while building proprietary databases of delivery points. Many operators now maintain detailed internal systems that supplement public mapping with customer-verified coordinates and delivery notes.

| Challenge | Traditional Solution | Modern Approach |

|---|---|---|

| Missing street numbers | Phone customer for directions | GPS coordinates database |

| Landmark-based addresses | Local driver knowledge | Digital landmark mapping |

| New construction areas | Manual route finding | Real-time mapping updates |

| Multiple language address formats | Bilingual drivers | AI translation tools |

Crowd-sourced addressing helps fill gaps where official systems fall short. Delivery drivers contribute location corrections and new address data, building comprehensive databases that improve over time. This collaborative approach helps companies maintain competitive advantages through superior local knowledge.

Ensuring secure delivery in high-value residential compounds

Gulf countries feature numerous high-security residential compounds and gated communities that present unique delivery challenges. These developments often house expatriate families and wealthy locals, creating high-value delivery destinations with strict security protocols.

Access control systems in these compounds typically require pre-authorization for all visitors, including delivery personnel. Guards verify identities, scan packages, and often escort drivers to delivery points. This process, while necessary for security, can add 15-30 minutes to each delivery attempt.

Timing restrictions compound the challenge. Many compounds limit delivery windows to specific hours or prohibit weekend deliveries entirely. Some communities require advance scheduling, making same-day or express deliveries nearly impossible without special arrangements.

Package handling protocols vary significantly between compounds. High-end developments may offer concierge services that accept deliveries on behalf of residents, while others require direct handover to recipients only. Some compounds maintain package storage facilities, but policies around liability and pickup procedures differ widely.

Building relationships with compound management teams has become essential for smooth operations. Leading delivery companies now employ dedicated account managers who work directly with community administrators to streamline processes and resolve recurring issues.

Security requirements extend beyond access control. High-value deliveries often require signature confirmation, photo verification, and sometimes video recording of handovers. These measures protect both customers and delivery companies but require additional time and technology investments.

Smart delivery solutions are emerging to address compound-specific challenges. Some operators deploy specialized lockers within compounds, allowing secure 24/7 package pickup while reducing security processing time. Others partner directly with compound management to integrate delivery scheduling with resident communication systems.

The rise of luxury e-commerce in the region makes compound delivery efficiency increasingly important for competitive advantage. Companies that master these complex environments often secure exclusive partnerships and premium pricing for specialized services.

Cost Optimization Strategies for Sustainable Growth

Consolidation Hubs Reducing Transportation Expenses

Smart consolidation hubs are transforming last mile delivery Gulf countries operations by dramatically cutting transportation costs. These strategic centers allow logistics providers to combine multiple shipments heading to nearby destinations, reducing the number of delivery vehicles needed on the road. Companies operating across the UAE and Saudi Arabia have seen transportation expenses drop by up to 35% after implementing consolidated distribution networks.

The key lies in location intelligence – placing these hubs at optimal points where delivery density is highest. For instance, major Gulf cities like Dubai and Riyadh benefit from micro-fulfillment centers positioned in high-demand neighborhoods, allowing couriers to handle more packages per trip. This approach works particularly well in the Gulf region’s densely populated urban areas where apartment complexes and business districts create natural consolidation opportunities.

Regional players are also leveraging shared consolidation facilities, where multiple e-commerce brands pool their resources to operate joint distribution points. This collaborative model spreads operational costs across several businesses while maintaining delivery speed and reliability.

Flexible Delivery Windows Maximizing Efficiency

Gulf logistics technology has embraced dynamic delivery scheduling to optimize route efficiency and reduce operational waste. Rather than offering rigid time slots, successful Middle East delivery solutions now provide customers with flexible windows that align with driver routes and traffic patterns.

This strategy pays dividends in Gulf cities where extreme heat during summer months means deliveries work best during early morning and evening hours. Companies can cluster deliveries during these peak windows, allowing drivers to complete more stops per shift while avoiding the midday heat that slows down operations.

Advanced routing algorithms consider multiple factors specific to Gulf markets:

-

Prayer times that affect business availability

-

Weekend schedules that differ from Western markets

-

Peak traffic hours unique to each city

-

Weather conditions that impact delivery speed

The result is a 40-50% improvement in delivery efficiency compared to traditional fixed-window scheduling. Customers appreciate the flexibility, while companies reduce fuel costs and driver overtime expenses.

Alternative Delivery Points Minimizing Failed Attempts

Failed delivery attempts cost Gulf supply chain management operations significant money – estimated at $15-25 per failed attempt when factoring in driver time, fuel, and rescheduling overhead. Smart companies are deploying extensive networks of alternative pickup points to solve this problem.

Popular solutions include partnerships with:

-

Shopping mall customer service desks

-

Grocery store pickup counters

-

Gas station convenience stores

-

Dedicated parcel lockers in residential areas

-

Office building reception desks

These pickup networks work especially well in Gulf countries where shopping malls serve as social hubs and people frequently visit them. Customers can collect packages at their convenience while businesses avoid the costs associated with multiple delivery attempts.

Parcel lockers have gained particular traction in UAE last mile delivery operations, with automated units placed in apartment complexes, metro stations, and shopping centers. These 24/7 accessible points eliminate timing conflicts that often cause delivery failures in the region’s busy urban environment.

Green Logistics Initiatives Cutting Operational Costs

Environmental consciousness is driving cost savings across Gulf delivery optimization strategies. Electric delivery vehicles, while requiring upfront investment, deliver substantial long-term savings in fuel and maintenance costs. Several major logistics providers in the region report 60-70% lower operating costs per mile with electric fleets compared to traditional diesel vehicles.

Solar-powered sorting facilities and distribution centers are becoming standard in Gulf countries, where abundant sunshine provides free energy for warehouse operations. These facilities can reduce electricity costs by 80-90%, creating significant competitive advantages in cost-sensitive delivery markets.

Route optimization software focusing on fuel efficiency has also proven valuable. By analyzing traffic patterns, delivery density, and vehicle capacity, these systems can reduce fuel consumption by 25-30% while maintaining service levels. The software considers region-specific factors like weekend shopping patterns and Ramadan schedule changes that significantly impact delivery route efficiency.

Green packaging initiatives, including reusable delivery bags and biodegradable materials, reduce waste disposal costs while appealing to environmentally conscious consumers. Companies report packaging cost reductions of 15-20% when switching to sustainable alternatives, particularly for recurring delivery services like grocery and meal delivery.

Future Trends Shaping Regional Delivery Evolution

Autonomous vehicles transforming urban delivery networks

Autonomous delivery vehicles are rapidly reshaping last mile delivery Gulf countries operations, with the region’s forward-thinking governments creating favorable regulatory environments for testing and deployment. The UAE has emerged as a global testbed for autonomous delivery technologies, with Dubai’s Roads and Transport Authority partnering with companies like Nuro and Starship Technologies to pilot self-driving delivery pods across urban areas.

Saudi Arabia’s NEOM megaproject represents the most ambitious autonomous delivery network planned globally, featuring fully integrated smart city infrastructure designed from the ground up to support unmanned delivery vehicles. These autonomous systems promise to address the region’s most pressing delivery challenges, including driver shortages and extreme weather conditions that make traditional delivery methods inefficient during peak summer months.

Current pilot programs across Gulf logistics technology networks demonstrate significant cost reductions, with autonomous vehicles operating 24/7 without labor constraints. Companies like Careem and Talabat are investing heavily in autonomous delivery fleets, recognizing that the technology could reduce delivery costs by up to 40% while improving service reliability.

The integration of autonomous vehicles with existing warehouse automation creates seamless end-to-end delivery chains. These systems can navigate the region’s complex urban layouts, from Dubai’s high-rise districts to Riyadh’s sprawling neighborhoods, using advanced AI mapping and real-time traffic optimization algorithms specifically calibrated for Gulf market conditions.

Blockchain technology enhancing supply chain transparency

Blockchain technology is revolutionizing supply chain transparency across Middle East delivery solutions, providing unprecedented visibility into package journeys from origin to destination. Major logistics providers like Aramex and Emirates Post are implementing blockchain-based tracking systems that create immutable records of every delivery milestone, significantly reducing disputes and improving customer trust.

The technology addresses critical transparency challenges in regional delivery challenges by creating decentralized verification systems that prevent package tampering and delivery fraud. Smart contracts automatically execute payment releases when delivery conditions are met, streamlining operations between retailers, logistics providers, and customers across the Gulf region logistics ecosystem.

Dubai’s government has mandated blockchain adoption for certain high-value shipments, positioning the emirate as a regional leader in supply chain innovation. The Dubai Blockchain Strategy 2025 includes specific provisions for logistics transparency, requiring major delivery companies to implement blockchain tracking for government contracts.

Real-time data sharing through blockchain networks enables better coordination between multiple delivery partners, customs authorities, and recipients. This enhanced transparency particularly benefits cross-border shipments within the GCC, where packages often traverse multiple jurisdictions before reaching final destinations.

Sustainable packaging solutions meeting environmental goals

Gulf delivery optimization strategies increasingly prioritize sustainable packaging solutions as regional governments implement stricter environmental regulations and consumers demand eco-friendly delivery options. The UAE’s single-use plastic ban has accelerated adoption of biodegradable packaging materials specifically designed for the region’s hot, humid climate conditions.

Major e-commerce platforms operating in Gulf supply chain management networks are transitioning to innovative packaging alternatives, including mushroom-based packaging, seaweed wraps, and recycled cardboard solutions engineered to withstand extreme temperatures during transport. Amazon’s Middle East operations have committed to 100% recyclable packaging by 2025, setting industry benchmarks for sustainability.

Saudi Arabia’s Vision 2030 includes specific targets for packaging waste reduction, driving innovation in reusable delivery containers and circular economy models. Companies like Noon and Carrefour are piloting returnable packaging programs where customers receive incentives for returning delivery boxes in good condition.

Smart packaging solutions incorporating temperature sensors and freshness indicators help reduce food waste in grocery deliveries, a critical concern given the region’s preference for fresh produce and the logistical challenges of maintaining cold chains in desert climates. These technologies ensure optimal product quality while minimizing packaging waste through precise environmental monitoring.

Regional partnerships with packaging manufacturers have led to development of climate-specific solutions that maintain product integrity while using minimal materials, balancing environmental responsibility with operational efficiency across UAE last mile delivery and Saudi Arabia delivery services networks.

The last mile delivery landscape across Gulf countries is transforming rapidly through smart technology adoption and strategic partnerships. Companies that embrace automated sorting systems, real-time tracking, and AI-powered route optimization are setting themselves apart from competitors. The region’s unique geographical challenges and extreme weather conditions require tailored solutions, but businesses that invest in local partnerships and understand cultural preferences are finding success.

Looking ahead, the Gulf’s delivery market will continue evolving with drone technology, autonomous vehicles, and sustainable packaging solutions becoming standard practice. Companies should focus on building flexible delivery networks that can adapt to changing customer demands while maintaining cost efficiency. The businesses that survive and thrive will be those that balance cutting-edge technology with human-centered service, creating delivery experiences that exceed customer expectations in this competitive and fast-growing market.

For Shipping and Last Mile Solutions contact us at info@alfurqanshipping.com